Features

Our Clean Energy Impact

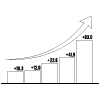

USD 44 Million*

Total Portfolio Size

10 Years

Project Life

43.15 Megawatt

Output Generation Target

848,700 tCO₂eq

Emission Reduction Target

The Green Climate Fund (GCF) is the world’s largest fund dedicated to combating climate change. It supports developing countries by providing flexible financing and technical expertise to reduce emissions, build climate resilience, and pursue sustainable, country-led development.

We are the first private-sector bank accredited by the GCF, enabling us to support underserved communities and businesses to transition to clean, solar energy.

Agriculture

- Ticket Size: up to PKR 10 million

- Purpose: Financing Solar PV solutions tailored for agricultural needs.

Residential

- Loan Cap: up to PKR 5 million

- Purpose: Financing for residential solar solutions to help households reduce electricity costs and carbon footprint.

SME (Small & Medium Enterprises)

- Loan Cap: Up to PKR 50 million

- Eligibility: Businesses with up to 250 employees, paid-up capital up to PKR 25 million, and annual sales up to PKR 250 million.

- Purpose: Financing for solar PV installations to integrate sustainability in business operations.

Residential – JS GharApna

- Pakistani national

- Minimum Employment/business Tenor of 2 years

- Age:

- Min: 27 Years (Salaried & Self-Employed)

- Max (at loan maturity):

- Salaried: 60 Years

- Self-Employed: 65 Years

- Minimum Income:

- Salaried (Gross per month):

- Permanent: Rs. 75,000.00

- Contractual: Rs. 100,000.00

- Self-Employed: An average of Rs. 100,000/- balance per month

- Active tax filer with NTN number

- Owner of the resident (House) where the solar facility is to be installed

- Installation at the Parents’ rented home/flats is also financed (subject to NOC from them)

- For owned, rented, and properties in housing societies (subject to NOC from authorized society office) and flats (only hybrid/off-grid systems)

- Financial ability to afford and repay finance

- Salaried (Gross per month):

Small-to-Medium Enterprises – JS Smart Roshni

- Pakistani national

- Operating business for at least one (1) year with sufficient knowledge of the business

- Proof of ownership of premises for solar installation should be provided. In case the property is not owned (leased/rented), NOC from the owner would be required in the favor of the bank from the property owner which includes the tenure of the financing, current rent amount and permission to repossess the system in case of any default.

- Satisfactory credit history of existing bank borrowings

- Financial ability to afford and repay finance

Agriculture – JS Agri Energy Finance

- Pakistani National

- Age: Maximum 65 years on expiry of the facility

- Permanent resident of the Area

- Satisfactory credit history of existing bank borrowings

- Financial ability to afford and repay finance

- Available till the facility is exhausted.

- Terms and conditions apply.

- Pakistan Distributed Solar Project-related complaints will be promptly handled by the Customer Care Unit, ensuring a formal and confidential resolution. For more details, please visit Touchpoints.